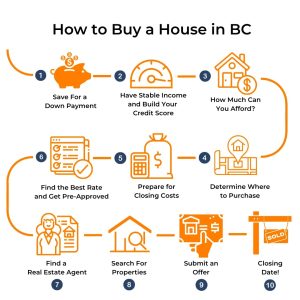

Purchasing a home is no easy task. It is crucial to get it correct because it is one of the biggest and most significant purchases you will ever make. If you are able to move into a house you can picture yourself living in while remaining within your budget, that’s what makes the process a success. We have created a 10-step guide to buying a home in lovely British Columbia because this procedure involves several steps.

Be sure you’re in a good place emotionally and monetarily to make this investment before you get started. In the regions surrounding Vancouver, where home prices have skyrocketed over the past decade, this factor takes on added importance. You can find useful information to help you decide if now is the right moment by consulting the following sources:

- When consulting with a mortgage broker and real estate representative,

- Checking out WOWA’s lease vs. purchase tool, and

- Consultation with loved ones and trusted acquaintances

Having a grasp of the procedure will be useful regardless of your final decision.

1. Aiming For A Down Payment

When trying to buy a home in a city like Vancouver, where the average price is over $1,150,000, a substantial down payment is essential. When you hear this, you might start to wonder: how much of a down payment do I need to buy a home in British Columbia? For homes costing more than $1,000,000, a 20% down payment is typically required. This means that a home buyer in the Vancouver region looking to spend the average price on a home will need to save at least $230,000. Buying a home for less than $500,000, on the other hand, only necessitates a 5% down payment. A down payment of at least 5% is required for a mortgage on a home costing between $500,000 and $999,999, and the required down payment increases by 10% for each additional dollar spent, up to a maximum of 10% down on a home costing $1,000,000 or more. You’ll need mortgage insurance if your down payment is less than 20% and your purchase price is less than $1,000,000. Insurance premiums may reach:

- If your down payment is between 5% and 9.99%, you’ll spend only 4% of the total mortgage amount.

- 3.10 percent of the loan principal for deposits between 10 and 14 percent, and

- 2.8% of the loan’s principal sum for down payments between 15% and 19.99%

You’ll need a sizable nest egg regardless of where you purchase or how much you plan to spend to make your dream of homeownership a reality. Check out WOWA’s down payment tool if you want to know how much money you’ll need for a down payment on a house. How much you spend each month on your mortgage is needed to determine your GDS ratio. WOWA has a handy down payment tool where you can get an estimate of this sum.

If you want to buy a home someday, sticking to a strict budget is one strategy for amassing the cash you’ll need for a down payment. If you want to make a sizable down payment, or if the market you’re interested in is prohibitively costly, you may need to reduce some of your discretionary spending in order to save more money. Finding a secondary gig or going freelance is yet another way to jumpstart your savings for a down payment. An additional source of income, such as a part-time job or freelance work, can be applied directly to your down payment savings, accelerating the process if your primary source of income is already adequate to cover your expenses and give you some to spare.

Finally, many first-time buyer assistance programs are available from the federal government to assist you in acquiring a house.

- For properties up to $722,000, the Canadian government offers a First-Time Home Buyers Incentive that provides up to $25,000.

- The British Columbia government offers tax breaks on property transfers for homes costing less than $500,000 and on properties costing less than $525,000.

- With the Home Buyers Plan, you can make a tax-free down payment of up to $35,000 from your RRSP funds.

It will make a huge difference in your ability to finance a first home if you take the time to learn how and if these programs can assist you.

2. Get a steady job and work on your credit

Having a reliable source of income is essential before entering a competitive real estate market, such as the one found in many British Columbian towns. This consistency will enable you to save and make the mortgage payments, which is especially helpful in a province with such high real estate costs.Furthermore, the security of property is not always guaranteed. Having the money on hand to fix or replace a broken or malfunctioning household item can alleviate a great deal of worry. Putting money away into a savings account every paycheck is essential, especially if you are self-employed or a contract worker with a less stable income. It’s important to remember that the total cost of homeownership includes more than just your mortgage and interest payment each month. Using our advice, you can choose from among Canada’s 15 best house insurance providers.

Lenders rely heavily on a borrower’s credit score as a sign of the borrower’s ability to repay loans. The Canada Mortgage and Housing Corporation (CMHC), which insures mortgages on homes worth less than $1 million, has its own minimum credit score requirement of 600. Check your credit score against this threshold and try to improve it if necessary if you intend to buy a home for less than $1,000,000 and put down less than 20%.

You can still locate a lender even if your credit score isn’t perfect. While you can find private mortgage lenders and B-lenders, they typically offer mortgage rates that are significantly higher than those offered by banks or by a protected mortgage. As a result, it could be wiser monetarily to focus on improving your credit and saving up for a larger down payment.

3. Asking how much money you can spare

The next critical stage on the road to home ownership is to gain an understanding of your financial situation. Credit scores, down payments, debt service ratio limits, and monthly expenditures are all factors in qualifying for loans, but ultimately, it’s up to the borrower to decide what feels like a reasonable amount to spend. A strict budget will help you avoid unnecessary worry and financial hardship once you figure out how much you want to spend on a home.

WOWA’s affordability calculator makes it simple to get a sense of how much you might be able to purchase.

4. Shop Around Before You Buy

Checking out potential areas and doing some background reading can help you make a more educated decision about where to concentrate your search and where you can see yourself living. Examples of this are:

- Performing drive-by inspections of the area,

- Having investigated the local institutions,

- How lengthy will your commute be? Can you get there using public transportation? and

- finding out about the area and assessing its safety

You can always update your home’s paint job or carpet, but you can’t alter the neighborhood. Whether it’s your first house or you’re just trying to make ends meet, finding a neighborhood you’re excited to call home is crucial. Since you can always make improvements as you begin paying down your mortgage, with the help of a home equity line of credit, or when you refinance, the most important factor is finding the appropriate location.

5. Budget for the Closing Expenses

The closing expenses on a home purchase are usually the second largest expense after the purchase price itself. It’s crucial that you are aware of these expenses so that you can maintain a comfortable standard of living despite them. Property transfer taxes, which make up the bulk of closing expenses, are subject to the following marginal tax rates in British Columbia:

However, if your home’s purchase price is less than $500,000, as we discussed in Step 1, you will be qualified for a rebate that will cover the full amount of your Property Transfer Tax. A rebate is available for prices up to $525,000, but it won’t be enough to pay the full amount.

The final price of a home purchase in British Columbia can also be affected by:

- Legal Representation and Costs,

- Survey Fees, What to Expect to Pay When Buying a Home

- Money needed for a home inspection,

- Cost of an appraisal,

- Title Protection,

- Taxes, Duties, and Registration Charges,

- There is a cost associated with obtaining an Estoppel Certificate.

To know how much a house really costs, you should make sure you have enough money set aside before you even start looking.

6. Start with Pre-Approval and Shop Around for the Lowest Rate

Getting pre-approved for a mortgage is crucial because it provides you with more insight into your financial situation. What this data might consist of is:

- Money available for spending,

- The sum of money a lender agrees to grant you,

- Expected interest rate, and

- Here is a rough estimate of how much your weekly bills might cost.

A pre-approval is crucial since all of these factors should be taken into account when making a buy and shaping your budget.

When you get pre-approved for a mortgage, it doesn’t mean you can’t still compare rates from various lenders. It is in your best interest to shop around for mortgage rates and lenders before settling on one. You could end up saving thousands of dollars in the long run.

Let’s say you’re looking to buy a home in Vancouver and have been pre-approved for a loan of up to $1.5 million. The down payment will be 20% of the purchase price of the house, regardless of its actual price. Your pre-approval and current bank account are with the same financial institution, and the following conditions apply:

- Five-year loans with a set interest rate and

- The current interest rate is 2.44 percent.

Let’s say you put in an offer on a home for $1,100,000 and it gets approved. You opt to keep looking for a mortgage instead of going with the one you already have pre-approval for. Interest on the mortgage you’ve been able to secure will cost you $98,863 over the course of the loan’s 5-year tenure.

You then find a second loan provider, this one providing a 5 year fixed loan for 1.99%. You will spend a total of $80,350 on interest fees with this credit. You see that the difference amounts to $18,513 in interest over the course of the 5 year period and decide to look elsewhere for your financing needs.

Buying a home in Manitoba ? Consider these ten helpful hints

7. Learn How to Locate a Realtor

Having a real estate representative on your side is a great investment because you, the buyer, will not be responsible for paying the real estate commission. Professional real estate brokers are available to help you with any aspect of the transaction, including but not limited to:

- Emotional backing,

- Make suggestions,

- Searching for houses to show you,

- Local neighborhood recommendations and

- making and mailing out official documents

It can be difficult to find the right agent, particularly if you are a first-time buyer. WOWA’s Real estate agent finder can assist you in this endeavor by introducing you to some of the best experts in your area. Here, you can meet with a number of real estate agents to find the one best fitted to represent your interests throughout the home-buying process.

8. To Find Homes in Your Price Range

Making a list of must-haves and wants is essential once you’ve hired an agent to start showing you houses and facilitating your home hunt. Details like these belong on the “must haves” section of this list.

- quantity of sleeping quarters,

- count of bogs,

- place of origin and

- Categories of Real Estate

To make a comprehensive wish list, you should think about things like:

- Forms of adornments,

- Possibility of additional space,

- Construction of flower beds and retaining walls

- As a result of technological progress,

Need-to-haves are permanent fixtures or aspects of the property that are essential, whereas nice-to-haves are purely aesthetic and open to negotiation.

You should maintain an open mind and act quickly when house hunting, whether in person with your agent or virtually using your local multiple listing service (MLS).

9. Make a Proposal

The next stage is to make an offer on the home if it has everything you’re looking for and is within your price range. Although you may fall head over heels in love with a particular home, it’s essential to remember that your offer may not be accepted on the first house you submit. In any case, that’s fine! Stay optimistic and lean on your loved ones, close pals, and real estate professional for support.

Keep your spirits up, be persistent, and with any luck, your offer on the perfect home will be approved before long.

How to Get a Home in Alberta: A Step-by-Step Plan for citizens and non-citizens

10. Date of Closing!

The time has come at last! Both excitement and anxiety may be felt at this moment. You’ll have to pay your closing costs in addition to packing, hiring a moving company, and recruiting friends and family to assist you move. Don’t fret, though; you planned ahead and made provisions for them in your budget during stage 5! WOWA’s closing cost tool makes it easy to determine these fees. Being prepared allows you to redirect your anxiety toward more pressing matters, such as wall painting and furnishings placement.

In Conclusiveness

After reading this, you should be in a much better position to save for a down payment, choose a location, locate a real estate agent, and make a bid on a house. It’s important to keep a positive attitude and rely on your loved ones as you go through this process. Your agent, mortgage broker, friends, and relatives are all here to assist you in making this crucial choice. You should be familiar with the eviction procedure in British Columbia if you plan to purchase rental property there.