Do you want to add a fireplace or some windows to your home? Or you might be thinking about bigger jobs like remodeling the kitchen, adding a room, or replacing the roof. You might have big plans for making changes to your home, but you also need a plan for how to pay for them. If you don’t have enough money saved up to pay for your home improvement job, you can use home renovation loans to pay for it.

What Exactly Are Loans for House Repairs?

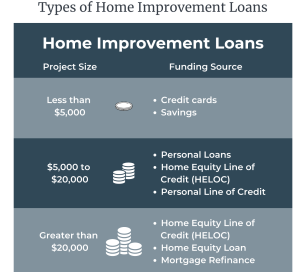

The options for how to finance your home improvement are as varied as the kinds of renovations you can undertake. There are five main categories of financing for renovating a home:

- Equity loan for the house (HELOC)

- The Equity in Your Home and a Loan

- Changes in a mortgage’s terms

- Individual Loans

- Using a credit card

It is possible to borrow money to make repairs and improvements to your house using any of these financing options. However, the amounts available for borrowing, the complexity of the application process, and the associated costs vary widely between the available choices. The minimum credit score, annual revenue, loan amounts, and interest rates required by each of these home improvement loan programs can vary widely. Which choice is best for you will rely not only on the scope and duration of your project, but also on your budget constraints. You can pay for your home improvement project with a single loan or a mix of them, such as charging expenses to a credit card while you apply for a home equity line of credit.

When weighing the various financing choices available for home improvements, the following factors should be prioritized:

- Money needed to acquire

- Quantity of money that can be borrowed

- How challenging it is to get a loan

Taking Out a Loan Against Your Home’s Value

You can use the value of your house as collateral to obtain a fixed-rate loan called a home equity loan. Large home improvement projects that call for a sizable down payment can benefit greatly from the cheap interest rates available through home equity loans. The catch is that you can’t just borrow money against the value of your house and call it a home equity loan. For a home equity loan to be an option, you’ll need to have 20% equity in your house.

Loan Against Equity in Your Home (HELOC)

A home equity line of credit, or HELOC, is a form of revolving credit based on the borrower’s home equity, comparable to a home equity loan but with a higher maximum loan amount. As long as you don’t go over your credit limit, you can take out as much or as little money as you need whenever you want. The low HELOC rates and adaptability of HELOCs make them a fantastic option for ongoing projects with costs that can be paid for in installments over a period of time. This way, you can limit your borrowing to emergencies only. To qualify for a HELOC, you need to have at least 20% equity in your house if you have a mortgage, or 35% equity for a stand-alone HELOC, similar to the requirements for a home equity loan.

Some HELOC lenders even make it convenient to make transactions with your HELOC by providing access or bank cards. You can use the funds from your HELOC to make in-store or internet purchases of materials for your home improvement project. A home equity line of credit (HELOC) with an access card is similar to a credit card in terms of ease of use, but it typically has a much lower interest rate and a much larger credit limit. A HELOC’s minimal monthly payment, which typically consists of just interest, is often much smaller than that of credit cards. In contrast, credit cards typically call for a minimum monthly payment equal to at least one percent of the amount, plus interest.

Loan Refinancing

If you want to get some extra cash out of your mortgage, you can do a “cash-out refinance,” which entails switching to a new loan with a higher interest rate and principal. The borrowed sum equals the difference between your current mortgage balance and your previous one. The money you receive can be put toward the cost of the house repairs you need to make.

There could be penalties or costs associated with refinancing your mortgage, but this would depend on when you did it. When you refinance your mortgage during the period, you may incur mortgage prepayment penalties from your lender. In order to avoid paying early termination fees, it’s best to refinance your mortgage when its tenure is up for renewal. Your present lender may charge a discharge fee if you refinance with a new one.

Although you can borrow up to 80% of your home’s worth through a refinance, you won’t be able to take advantage of the low mortgage refinance rates. On the other hand, a home construction loan could be a better option for bigger projects or brand new construction.

Money Borrowing

When compared to mortgage refinancing or a home equity line of credit, the application procedure for a personal loan is simpler and faster. A good candidate for this type of loan is someone who needs money quickly to cover renovation costs but doesn’t have enough equity in their house to qualify for a secured loan. Your ability to negotiate a reduced interest rate with your lender may hinge on your presentation of a detailed construction plan. In order to have a well-defined construction plan and budget, you may need to calculate all of your expenditures, such as the amount of paint you will need.

Unsecured loans, such as personal loans, carry a greater interest rate than secured loans. Also, factors like a low salary or low credit score can result in a much higher interest rate.

Charge Card

As credit card interest rates tend to be quite high, using one to take out a loan isn’t a good plan if you won’t be able to pay it back quickly. Financing a small home improvement job, say one that will cost a few thousand dollars, with a credit card can be a convenient way to spread out the payment over a shorter period of time. Using a credit card to finance home improvements is not a good plan if you need more time to pay off the loan and cannot afford the minimum payment right away. However, credit cards typically feature a 21-day interest-free time. While waiting for their next salary, some people will use a cash-back credit card to pay for necessary home improvements.

Retailer Payment Plans

In Canada, you can get a store credit card at a number of hardware and home repair stores. Extra benefits, such as an expanded return policy, warranty extensions, and discounts may be included with the use of these credit cards. A store credit card can be a fast and simple way to get the financing you need for smaller home improvement projects.

Home Depot is the market leader in Canada, followed by Lowe’s. There are a variety of credit services and financing options available to customers at national home renovation retailers like Home Depot, Lowe’s, Rona, and others. In most instances, neither professional status nor commercial contractor experience are prerequisites for participation in such schemes.

Financing initiatives in stores typically work with external organizations. In eastern Canada, Desjardins Accord D funding is used by businesses like BMR Group, which operates a chain of hardware stores. Flexiti provides instant funding for Castle Building Centres customers. Fairstone Financial is a partner of Timber Mart.

Home Depot

Home Depot is a credit card issuer that caters to both consumers and businesses. The Home Depot accepts applications for both customer credit cards and construction loans from anyone. Home Depot provides business clients with a commercial account and a commercial rolling credit card. The business account operates like a charge card and the revolving card like a credit card, both of which require monthly payments to keep the balances at zero. Members of the Home Depot’s business sector who have a Pro Business Account and Pro Xtra Rewards may be eligible for a 60-day 0% APR promotional period on certain purchases made with the business Revolving Card or Commercial Account.

Home Depot Store Credit Card

- Rate of Interest, 28.80%

- One year extension on the return policy

- Zero percent financing with a minimum buy

Home Depot partners with Citi Cards Canada (Citibank) to offer the Home Depot Consumer Credit Card. The card is simple to register for both online and in-store, and it comes with perks like a year-long grace period for returns. This is longer than the 90 day return period provided if you use any other payment method. Credit cardholders of The Home Depot receive access to exclusive discounts and deals. Keep in mind that the Home Depot Credit Card treats all purchases as security interest for the card amount, or collateral. If you fail to make your credit card payment, then Home Depot can repossess the items that you have bought using the card.

In March 2020, the interest rate of the Home Depot Credit Card rose from 23.25% to 28.80%. The Home Depot Credit Card has an extremely high interest rate of 28.80% per year as of this writing. It’s also higher than normal consumer credit cards. This credit card has no annual charge. To make up for the high interest rate, the card has different offers for those that just need temporary financing for their renovation expenditures.

The Home Depot offers a promotional discount of $100 off your first buy of $1,000 or more made with your new credit card within the first 30 days of account opening. If you make a buy of more than $299 and pay off your card in full within 6 months, you won’t be charged interest on the balance. In the seventh month, interest rates rise to 28.8%. A 12-month 0% APR promotion is available for purchases over $299 of significant home appliances or professionally installed projects.

Offers with zero percent interest for 18 months rotate and are available in a few different categories. To give you an idea, if you buy an HVAC system costing $2,000 or more between October 14, 2021 and December 8, 2021, you won’t have to pay any interest on the acquisition for 18 months.

Here’s How a Credit Card from Home Depot Works as an Example

If I wanted to take out a loan for $10,000 on my Home Depot Credit Card, how much would it cost? An yearly percentage rate of 28.80% is being charged. Considering a loan term of 12 months:

- The Amount We Are Borrowing is $10,000.

- Rate of Interest, 28.80%

- Indicative of One Year’s Time

If the amount stays the same throughout the year at $10,000, the interest expense for that time period will be $2,880. One percent + interest is due every month at the very least. This means that the first month’s minimum payment would be $100 + $240 in interest. There is a grace period of 25 days for this card, which means that if the balance is paid in full before the end of the grace period, no interest will be due for the prior billing cycle.

Mortgage Financing from Home Depot for Your Next Big Project

- Loan Rate: 8.99%

- Obtain a loan of up to $50,000 with no origination fees.

- The shopping period is 6 months and the payment period is 5 years.

Home Depot provides a loan with a cheaper interest rate than their store credit card, and it can be used for project purchases. To make in-store and internet purchases at Home Depot, you can get a no-interest loan of up to $50,000 with no collateral required. The money from the loan cannot be used to shop at any other stores or shops for the duration of the endeavor. You now have a six-month buying window. The repayment schedule for the project loan is 60 months, or five years, after the purchase time ends.

The project financing has an APR of 8.99% per year, with no fees charged on a yearly basis. The Home Depot Project Loan’s interest rate jumped from 6.99% to 8.99% in February of 2020.

If you need to, you can make early payments or even pay off your entire project debt without incurring any fees. It is possible to apply for extra project loans to give you more time than six months to finish your project’s purchasing.

Exemplification of a Loan for a Special Purpose

Scenario: you have $10,000 to spend on building materials at Home Depot. Ten thousand dollars can be borrowed for a period of 5 years through the Project Loan at an interest rate of 8.99%. The Project Loan from Home Depot, how much would it cost to borrow?

- The Amount We Are Borrowing is $10,000.

- Loan Rate: 8.99%

- Tenure: Five Years

Payments of $208 per month are due at the current rate of interest. The entire amount due ($12,452) is spread out over the loan’s 5-year repayment term. When applied to a $10,000 Project Loan, that comes out to an interest cost of $2,452.

Lowes

Home Depot Consumer Credit Card

- Rate of Interest, 28.80%

- For orders over $299, there will be no interest charged for 6 months.

- In-store applications receive a one-time rebate of 10%.

Lowe’s credit card provides no-interest promotions that are comparable to those found on the Home Depot card. Any purchase of $299 or more is eligible for no-interest financing for 6 months, with no payments due during that period. You can get up to 12 months with no interest or payments needed for certain items and other categories. For those who require additional time to pay, we offer extended payment plans of up to 48 months for orders over $1,499 at an interest rate of 8.99%. Synchrony Financial Canada is the company in charge of processing payments for Lowe’s credit cards. There is a one-time discount of 10% off your purchase, up to $100, available in-store when you register.

Lenders for Lowe’s Commercial Operations

- No payments or interest for 60 days

- Every day, get a 5% reduction on everything.

- When you register in-person, you’ll receive a one-time discount of 10%.

A 5% discount applies to all transactions made with your Lowe’s Business Account Credit Card. Additionally, you will receive a 10% discount off of a single transaction, up to a maximum savings of $100. Lowe’s provides a commercial account receivable to help bigger businesses keep tabs on employee spending and inventory.

Rona

In January of 2021, Rona stopped offering the majority of its funding options, including the Rona Visa Desjardins credit card and Rona Commercial products. At the moment, the only method of payment that Rona accepts is a monthly plan.

Rona offers a multi-purchase plan that allows you to spread out your payments over a period of two months with zero percent interest on all home renovation purchases. For three months, you’ll pay nothing in interest on purchases of $99 or more; for six months, you’ll pay nothing on purchases of $299 or more. With Rona, you can pay in equitable monthly installments. Equal monthly payments are due every 24, 36, 48, or 60 months.

Rona offers a payment plan with an interest rate that varies with the total amount of the transaction. transactions over $2,500 qualify for 4% interest over 24 months, while transactions under $2,500 incur a 13.5% APR. Desjardins Accord D is the financial institution that offers financing for Rona purchases.

An Illustration of Rona Financing

What would be the difference between the yearly interest rate of Rona’s monthly payments for a $2,000 loan and a $3,000 loan?

Interest payments on a $3,000 loan over 2 or 3 years will be lower than on a $2,000 loan over the same time period. To borrow $3,000 over 3 years would cost $285.57, while borrowing $2,000 over the same period would set you back $443.34. When compared to the expense of borrowing $2,000 over the same time period ($485.18), borrowing $3,000 over the same period would set you back $727.77.

Buying a home in Manitoba ? Consider these ten helpful hints

Should I Take Out a Loan to Remodel My House?

The value of your house isn’t the only thing that can increase thanks to renovations. The quality of your life and the functionality of your house can both benefit from a remodel. This can include making your house more comfortable or secure, in addition to making it more energy efficient and saving you money on your energy and water bills. The cherry on top is that house improvements can raise your home’s resale value, which can more than offset the renovation costs. Potential purchasers may also be enticed by the fact that you have recently renovated the house.

Renovating your home can be a good plan if you have a specific goal in mind and have enough money to cover all of the costs, including the monthly payments on a home renovation loan. You can avoid saving up for all of the money you’ll need to make improvements by applying for a renovation loan. You may be able to get a loan or credit card from a store that provides no interest for a set period of time. This can serve as bridge funding while you seek out permanent solutions. It’s important to remember that even the most basic credit cards offer a 0% interest moratorium period if paid in full within that time frame.

However, a home improvement debt still needs to be repaid. With a second mortgage or home equity line of credit, you have access to a sizable sum of money that can be easily spent beyond your means. If you want to avoid spending more money than you have, creating a schedule in advance is essential. Renovating your home may not be the best option if you can’t comfortably afford the additional loan payments. This is because renovation loans are loans, not free money.